6 Simple Steps to Build Wealth

Whenever I would hear different teachings on wealth building, it felt like I was standing too close to an elephant.

For instance, if a man did not know what an elephant was, and someone asked him the question, “What is an elephant?” he might be stumped to answer. If he only saw the trunk of the elephant, he might say, “Oh, an elephant is a hose.” Or, perhaps, if he looked up and only saw the side of the elephant, he might say, “Oh, an elephant is a wall.” Or, if he only saw the tail, he might say, “An elephant is a rope.” In other words, the man associated the whole object with only one part. But the truth is, an elephant is more than a trunk, a side, or a tail. An elephant is all those things.

In the same way, I struggled for a long time to fit all the different lessons on wealth building into one solid idea. I was looking for wealth building in simple terms. If I learned something that was about debt freedom, I’d put it over in the debt-freedom compartment in my brain. But I knew that building wealth was more than eliminating debt. I knew the trunk was attached to an elephant, so what I was really dealing with was an elephant.

Finally, after many years of experience, discussion, and learning, I received the Triple X Factor. This gave me the true 30,000 foot view of wealth building. I finally saw the whole elephant or the whole picture all at once.

Triple X Factor

Understanding this concept on wealth building can position you from being mastered by money to the point of mastering money. I call it the Triple X Factor.

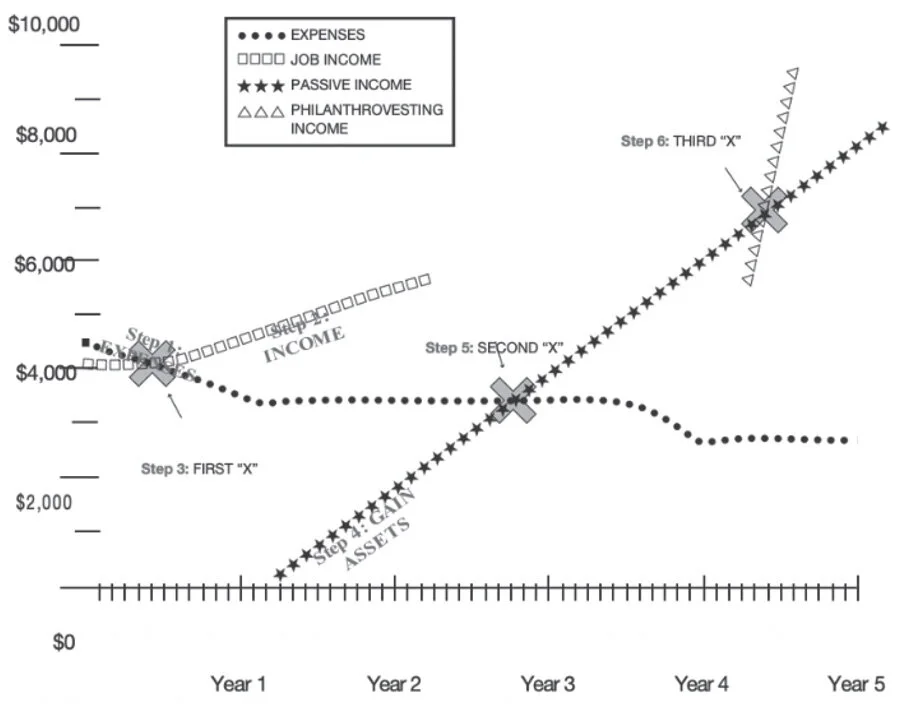

There are three levels within the Triple X Factor—First X, Second X, and Third X. First X Income is the starting point when you work and get paid for that work. Second X Income is a place of great freedom because you have and manage assets that pay you. Third X is a place of philanthropy and making a difference in other people’s lives. At the Third X, you’re donating or investing the majority of your income or assets for the benefit of others.

To begin wealth building, you must first find out where you are financially. A safe guess at the average American household income is about $50,000. For some states it is higher and for some it is lower, but this is a good starting point for our illustration.

When you look at the indebtedness of a typical household in the U.S., you will see more money going out every month than coming in. If $50,000 represents the average annual income in the U.S., then $54,000 represents the average annual household expenses. So, we are left with one question: How can someone spend more per year than they actually make?

Unique to western nations is the phenomenon of consumer credit. We can easily buy things that immediately depreciate in value by using consumer credit. We can buy things like TVs and clothes on credit because we have credit cards or other types of installment accounts. Therefore, in America, it is exceptionally easy to spend more than you make.

Each dot represents one month of expenses. So, for this illustration, at the beginning, we have about $4,500 going out each month. It’s important to position yourself in order to build wealth. I recommend building your own personal chart based off this.

1) Plot your expenses each month

To fill out your own chart, you need to be very honest about your expenses. Start with the month you’re in right now. Begin to chart your monthly expenses. For instance, let’s say you start in April, and the total outgo of expenses in March was $2,500. You would place an asterisk at the $2,500 mark. Then at the end of April, you would place an asterisk representing how much you spent in April.

Once you start implementing the tools in this book, you should begin to see your expenses go down. This will allow you to start paying off your debt while learning how to handle your finances better. However, for a lot of people, expenses don’t come down. They remain the same or may even go up until they can get control of their spending. If this happens to you, that’s okay. Start where you are, and with time, prayer, and work, you will eventually learn how to master this expense line.

2) Plot your income each month

Each square in the line represents monthly income. Chart your first month’s income in the same way that you charted your first monthly expenses. This line will probably stay horizontal for a while. But again, after you implement what you learn in this book, you’ll be able to start bringing value to the marketplace. And when you start bringing value to the marketplace, your income will begin to go up.

3) Build your First X

Now for some people, the First X is in good shape. In other words, they have more income than expenses. If this is the case, they can start building the Second X. But for most people, the First X is going to be in rougher shape. This means that they have more expenses than income. In this instance, the squares representing monthly income will stay even for now, but the dots—monthly expenses—are going to come down.

Most people will be able to start controlling their expenses, especially their consumer debt, before they start increasing their income. That’s completely normal. Start working on your expenses immediately by cutting things out, making extra, or driving down debt. It will take a little longer to grow your income.

When it comes to your income, always remember this: You take value to the marketplace not time. Most people think they take time because they get paid per hour, but the truth is, money is attracted not pursued. So, when you start working on yourself harder than you do on your job, you will get paid more for your job. This is because you become more valuable.

As your expenses begin to come down and your income begins to go up, you start to form the First X. In other words, you are in a position to begin building wealth. The First X is a great place to be. You either get out of debt, or gain control of it, and start mastering your finances. There is some teaching available out there on this aspect, but there’s not a lot on how to reach the Second X.

4) Gain assets

Keep graphing your income and expense lines every month so you can monitor exactly where you are. For example, as the First X forms, you’ll notice a gap developing between the line of squares and the dots. That gap is the excess capital that you now have available to you. What you do with that excess capital determines whether or not you will build wealth. You might be tempted to just spend it all, thereby not building any wealth. The good news is that at least you’re not getting into more consumer debt by doing this (hopefully), but the bad news is that you are still not building wealth.

The real key to building wealth is learning to invest your excess capital. Put that excess capital to work so you can begin to gain assets that produce income in your life. Start using this gap to create Second X income. For some people, it may take two, three, or even four years to reach a point where they have any excess capital to deploy or invest. That’s okay. Stay with it, and you’ll get there!

In this particular example, we’re looking at a 12-month period. Pay attention to the first asterisk on the left. That asterisk represents your first investment. You probably won’t have enough money to put a down payment on a piece of real estate, but you will have enough to open a savings account.

Several years ago, I was teaching at a conference at the Omni Hotel in Dallas, Texas. When I finished teaching on real estate, two huge guys, each about 6’5”, came up to me and said, “We’re ready to invest in real estate!”

They were pumped up from the talk, so I looked at them and said, “Well, do you have any money?”

“Well, no, we don’t have any money,” they said. “But we’re excited and ready to invest.”

Here’s how I answered them: “When you have $10,000 in your possession, call me. I’ll fly to Dallas at my expense, and I’ll teach you how to buy your first investment property.”

Six months later, one of the guys called me. He had $10,000, so I flew to Texas and helped him get started. Today he owns more than 60 individual properties—multi-family units and single-family houses.

You might ask, “What does this have to do with the first asterisk?”

Actually, it provides a lot of insight. Let me explain. This young man returned home and immediately started saving. He had a good income and put some money into a savings account. That was his first asterisk that began to build his income line to reach the Second X. By doing this, he positioned himself to begin acquiring assets. The goal is that the asterisks, representing income from assets, will progress upward and form a line.

Of course, if you put your money in a savings account, your return will be very low. That’s not a lot of income. Instead, if you put your money into assets with a better return, the asterisks will really start to accelerate.

A simple illustration of an asset that brings income is rental properties (single-family) with positive cash flow. The more investments of this type you can accumulate, the more the snowball will start rolling in the right direction.

As you build wealth, all of a sudden, your cars and mortgage will be paid off. The beauty of this is that when your house and cars are paid off, it doesn’t cost a lot to live. The dots, or your expenses, will continue to come down.

Note: You can start the asterisks without ever accomplishing the First X. If you’re not in a financial position to acquire assets, you can create assets instead and start the asterisks early. An example of creating an asset is starting a business outside of your day job, like an eBay or Etsy shop, that has immediate cash flow. Then you can use that cash flow from the business to start investing in assets or paying off debt.

Another way to do this would be to borrow for the purpose of investing in assets. I know many people who have started investing in real estate by taking out a second mortgage on their personal home. If they have enough real estate knowledge and acquire assets slowly (at least in the beginning), they can build Second X income from that acquired real estate.

5) Build the Second X

The key to the Triple X Factor is when the asterisks begin to take off as you acquire excess capital and put it into things that produce income for you. You will start investing and receiving better and better returns.

Here’s what happens once this occurs: The dots will continue to go down, and all a sudden, the asterisks will cross the dots. This means that your cost of living is covered by passive income. The moment that the asterisks become more than your cost of living is the moment you become financially free. That’s the moment when, if you want, you can quit your job.

I was able to reach financial independence in my personal life in two and a half years. But for some people, it may take a lot longer than that. It could take some people ten years to do this.

A lot of people ask me what their first goal should be when starting to build wealth. I always tell them what the Triple X Factor says: Your first goal—your first big goal—should be to replace your earned income with passive income. That’s it! That is the key to start experiencing financial independence.

In our seminars, we teach that there are six primary categories of passive income. Please note there are more, but these six will help you focus on the right types of income.

Capital Distributions from a Business

Dividends from Stock

Interest from Bonds and CDs

Royalties from Oil and Gas

Royalties from Songs and Books

If you notice, this income is not about buying and selling anything. For example, learning to buy and flip real estate is an effective money-making strategy but the income from it is not considered passive income. It is considered earned income and taxed at an increased level. If fact, we do cover flipping in our workshops, but the focus of this book is to teach you how to build passive income through real estate. We teach how to buy and sell (flip) real estate as an income strategy because most investors need to find more capital for down payments and repair costs in order to continue to build their real estate portfolio.

The financial industry in America tells you to put your asterisk money (see Triple X chart) in a 401(k), an individual retirement account (IRA), or some other type of retirement account. It’s definitely wise to have a retirement account set up—but that is a slow process. It can take a long time to build up wealth that way!

Many people who retire with a decent portfolio have never taken the time to learn how to invest because they never understood how taxes could steal their wealth. When they retire, they end up paying more taxes in what we call tax-deferred accounts than they were paying when they were actually working and earning a salary. The minute they start pulling that money out of those normal IRAs and 401(k) plans, they have to pay earned-income tax on that money. After all is said and done, they end up having much less than they thought they had.

The good news is that we have another instrument called the Roth IRA. Young people should certainly take advantage of this tool because that money grows tax-free down the road. Then when you pull the money out, you don’t have to pay earned-income tax on it. The best news, however, is that when you reach this point of financial independence, you can continue to grow an amazing portfolio, invest in all kinds of things, and truly begin to build wealth.

6) Build the Third X

Remember on the First X when the dotted line crossed the line of squares, and we had a gap? The same thing happens here. When the asterisks cross the dotted line, we will have another gap that represents excess capital again. It’s at that point that I marked: “Quit job!”

You may ask, “What do you do with that new excess capital?” This is the moment you can choose to really begin building wealth. This is where the Third X comes in.

Somewhere in that excess capital gap, you will reach a point where you can start giving all your excess income away and invest your assets for social impact and making a difference. Now everything you earn—100% from this passive income above the point where the asterisks meets the triangles—is surplus! You have reached the place where you and your family are already taken care of. You’re financially independent. You could even quit your job if you chose to do so. You are completely and totally financially free!